Feb 15, 2026

Is $1.2B Juspay Payments’ Underrated Workhorse?

Trading

Last month, Juspay announced a fundraise at a $1.2B valuation, becoming the first unicorn of 2026, in a year of quiet fundraises, especially at the growth stage.

Plumbing Payments

Before 2012, digital payments in India were fragile in ways most people had simply accepted.

Digital penetration in retail hovered around 1 % of its current level. Cash ruled nearly 95 per cent of transactions, not because consumers resisted technology, but because the infrastructure rarely worked when it mattered.

Card transactions failed frequently. OTPs timed out on 2G networks. Bank servers went down during peak hours. Check-out drop-off rates of 20–30 per cent were routine, spiking sharply during sales and high-traffic events.

Payment gateways such as CCAvenue integrated net banking flows across more than 40 banks, each running on legacy systems that could not scale. During major sales, failure rates can spike by 50-60 per cent. Peak-hour outages were expected. Whether a payment went through often depended on the time of day and the bank involved. For users, it felt like a game of chance.

Merchants adapted by lowering expectations. Despite the e-commerce boom, many still printed “Cash Only” signs because one in three card swipes failed. Even online, timeouts of 30–60 seconds on slow connections led to massive abandonment. During Diwali sales, checkout drop-offs at payment gateways climbed to around 78 per cent.

The regulatory environment did little to offset these constraints. In 2012, the RBI capped debit card MDR at 0.75 per cent to encourage adoption, but physical infrastructure lagged. There were fewer than five lakh PoS terminals nationwide, forcing most online businesses to rely entirely on fragile gateway integrations.

The result was fragmentation everywhere. Prior to UPI, users had to juggle 10 or more apps to complete a single payment. Cash remained the fallback, sustaining shadow transactions and leakages that digital systems were meant to eliminate.

Yet the ecosystem treated these failures as inevitable.

Banks blamed infrastructure. Startups blamed banks. Product teams focused on acquisition, discounts, and front-end experience. Payments were something you plugged in, not something you engineered.

Almost no one asked a more uncomfortable question. What if payments were not failing randomly, or if failure itself were predictable and fixable?

In the early 2010s, this was not a fashionable problem to work on. Venture attention was shifting to wallets and consumer apps. Reliability did not feature in pitch decks.

That blind spot was where Vimal Kumar began to look more closely.

Engineering for What Breaks

By 2012-13, India’s payment gateway market already had clear incumbents.

CCAvenue dominated with multi-bank net banking, offering integrations with more than 40 banks. But scale exposed its weaknesses. Poor routing logic meant failure rates could spike during peak-traffic periods, a reality merchants like Flipkart simply accepted as the cost of doing business.

EBS, before its acquisition by Ingenico in 2013, positioned itself as the most compliant player in the market. It was the first Indian gateway to achieve PCI DSS 3.0 certification. Yet reliability remained manual and brittle.

PayU, launched through Ibibo in 2011 and operating independently by 2014, along with DirecPay, focused on low-cost card and net banking acceptance. The emphasis was on coverage and pricing rather than on addressing the underlying causes of failure that plagued the ecosystem.

In 2012, Vimal Kumar began with a very different assumption regarding this payment problem.

Instead of asking how to make payments more delightful, the early team asked a harder question: where and why did payments actually fail after the user clicked “Pay”?

The answers were uncomfortable. Merchants such as early Snapdeal were effectively running payment lotteries. Randomised bank routing meant success often depended on luck. Post-8 PM blackouts were routine as legacy bank mainframes throttled traffic. In 2012, a gateway outage resulted in nearly ₹50 crore in festival sales for a travel platform because no automated retry mechanism was in place.

Juspay was born to solve this problem, to help customers Just Pay quickly.

Juspay’s early laptop-based testing uncovered bank-specific quirks that others had assumed were inevitable. HDFC’s systems, for instance, consistently lagged after 7 PM. Rivals dismissed such behaviour as “unfixable.” Juspay treated it as a data point.

The team realised that most failures were not happening at the UI layer. They occurred deeper in the stack. This would happen in the routing logic, bank handshakes, retry behaviour, timeout thresholds, and subtle mismatches between merchant systems and bank infrastructure.

Rather than build a wallet or a consumer-facing product, Juspay chose to sit low in the stack. It built SDKs and backend systems designed to improve transaction success rates.

In an ecosystem obsessed with growth, Juspay chose to optimise for reliability. But the growth-obsessed ecosystem would ultimately become the reason for Juspay’s increased importance.

Reliability as the First Product

As Indian consumer internet companies such as Flipkart and Ola grew rapidly, payment failures began to appear directly in revenue figures.

Marketing could drive traffic, but broken checkouts killed conversions.

By 2014, Flipkart’s GMV had surged to nearly ₹10,000 crore amid the Big Billion Days frenzy. Yet during peak traffic, payment glitches caused a 35 per cent drop-off rate, resulting in crores in revenue leakage. Juspay’s early work on smart routing and automated retries lifted transaction success rates from roughly 75 per cent.

Ola faced a similar reckoning. Between 2014 and 2015, ride volumes grew nearly tenfold, creating a systemic bottleneck in payments. A one per cent failure rate resulted in lakhs of rupees in losses each day due to failed rides, retries, and no-shows. Much of the friction was not visible. Two-factor authentication timeouts averaged 75 seconds across banks. Juspay’s optimisations reduced completion time to approximately 43 seconds, materially improving completion rates for Flipkart’s 100 million-plus users and Ola’s expanding rider base.

Juspay’s systems focused on exactly this layer of the stack: intelligent retries, adaptive routing across banks, and real-time handling of failure scenarios. When Flipkart’s 2014 sale crash exposed routing roulette across payment service providers, Juspay’s SDK automatically switched banks mid-chaos, recovering millions of rupees in a single night without requiring any frontend changes.

During a seven-hour PSP outage, Ola engineers observed that Juspay’s retry logic achieved a 12% increase in overall success rates, with up to 25% of previously failed transactions beingsuccessful. Internally, the product was nicknamed “revenue insurance.” The proofs were built the hard way. Founders simulated Flipkart-scale loads on laptops, mapping failure patterns that others dismissed as random.

The outcomes were measurable. Payment success rates improved. Drop-offs fell. Revenue leakage slowed.

These early engagements were small in contract value. Strategically, however, they were decisive. Juspay had earned the trust of companies operating at some of the highest transaction volumes in the country.

The phase focused on proof, and Juspay delivered it for India’s fastest-growing companies.

Staying Out of the Spotlight

Between 2015 and 2017, the Indian fintech sector expanded rapidly.

Wallet adoption scaled after demonetization. The number of wallet users increased from approximately four crore to over fifty crore in a short period. Cashbacks became the primary acquisition lever. Venture capital poured into consumer-facing payment apps competing aggressively for users, driving Paytm’s valuation to nearly $20 billion amid all-out user battles.

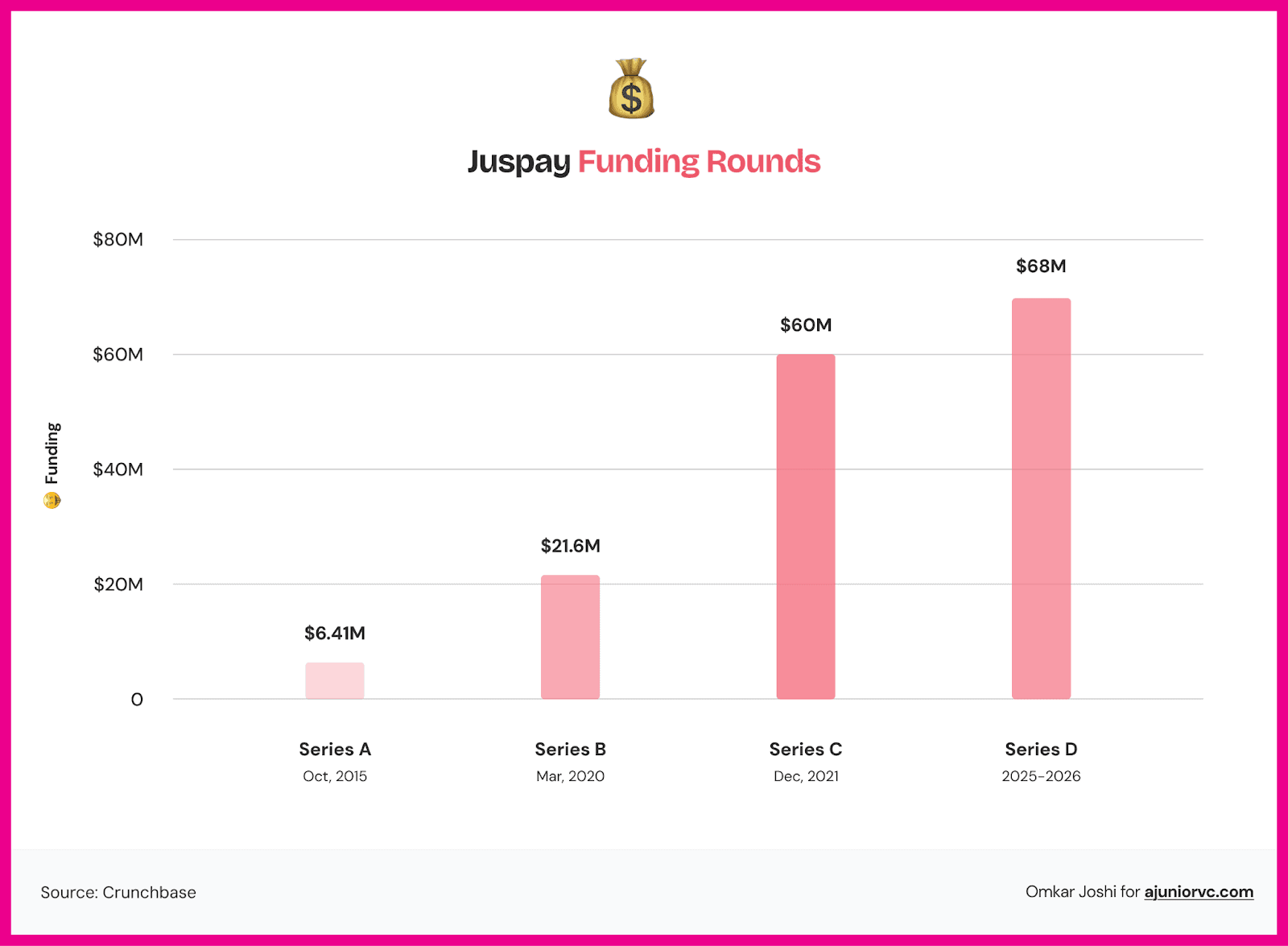

Juspay chose to sit this out. In fact, it was such an “uninteresting” company for investors that it could just get a 1.5 Cr angel investment at a 10 Cr valuation, led by former Network 18 CEO Haresh Chawla in 2014.

It did not want to own users or compete with its own merchant clients. It remained absent, necessitating constant marketing expenditure to build a brand. The company focused on strengthening backend plumbing.

While wallets fought for attention, Juspay’s SDK powered a 20–30 per cent increase in transaction success rates for large merchants. It processed millions in transaction value without chasing consumers or running campaigns. The company focused on providing neutral infrastructure trusted equally by merchants, banks, and platforms.

Capital flows during this period reinforced the contrast. By the end of 2015, the company had taken flight, attracting an enormous Series A of $5M, which showed how well its tailwinds were playing

In 2016 alone, more than $687 million was invested in consumer fintech apps. Subsequently, demonetization put this distinction into sharp relief. Digital payment volumes spiked nearly tenfold overnight, exposing how fragile many wallet systems were under stress. Juspay’s neutral routing handled the chaos. Enterprise clients expanded usage, with Juspay’s revenues growing more than 200 per cent during the period, even as rivals saw churn.

The economics told the same story.

Juspay generated an estimated ₹20 crore in revenue in FY17 and a small engineering-heavy team. During the 2016 payment blackouts, its systems automatically rerouted Ola and Flipkart transactions in ways competitors could not.

Within merchant teams, Juspay earned the nickname "the invisible glue." Founders repeatedly rejected wallet pivots, betting that low-churn, deeply embedded infrastructure would outlast consumer hype.

As wallet economics deteriorated and consolidation followed, Juspay’s position strengthened. Juspay embedded itself more deeply in systems that could not afford to fail.

Unified Interface Explosion

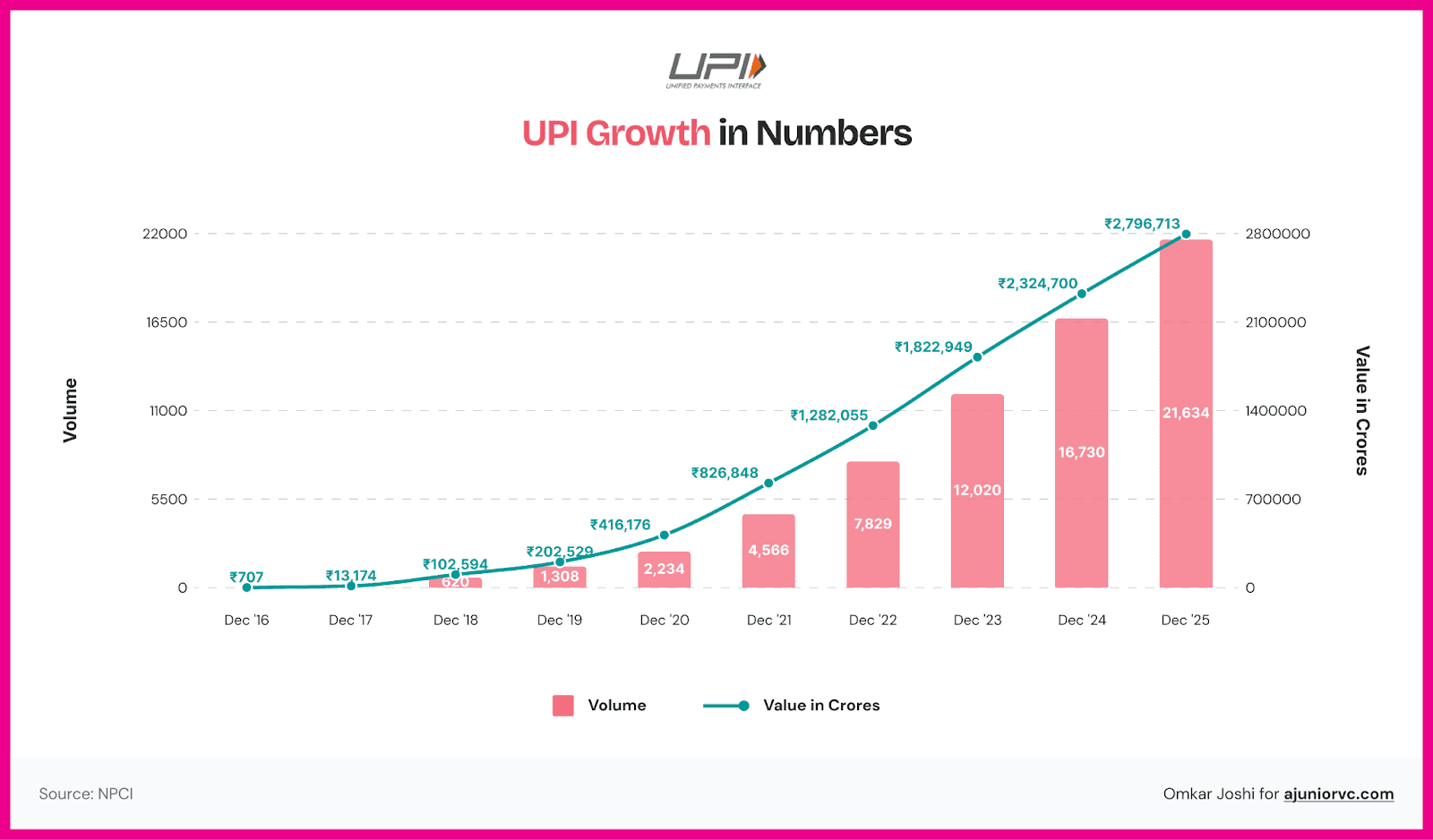

The launch of UPI in 2016 is often described as the moment payments in India became simple.

While simplifying the consumer side, it made the business side more complex. Between 2016 and 2019, UPI volumes surged from 93,000 transactions in August 2016 to nearly 80 crore in March 2019, representing over ₹1.3 lakh crore in value.

This was a more than 100-fold increase in activity, far outpacing any bank's infrastructure's ability to stabilise. Downtimes became frequent. Failure rates shifted from card rails to UPI. Coordination between banks, PSPs, NPCI, and apps introduced entirely new points of failure.

Early UPI failure rates hovered between 10 per cent due to fragile inter-PSP handshakes and mandate delays. During the 2017–18 surge, when volumes grew by nearly 400 per cent year-on-year, failures spiked to 25 per cent during peak periods. For large platforms, this translated into crores in lost revenue through drop-offs.

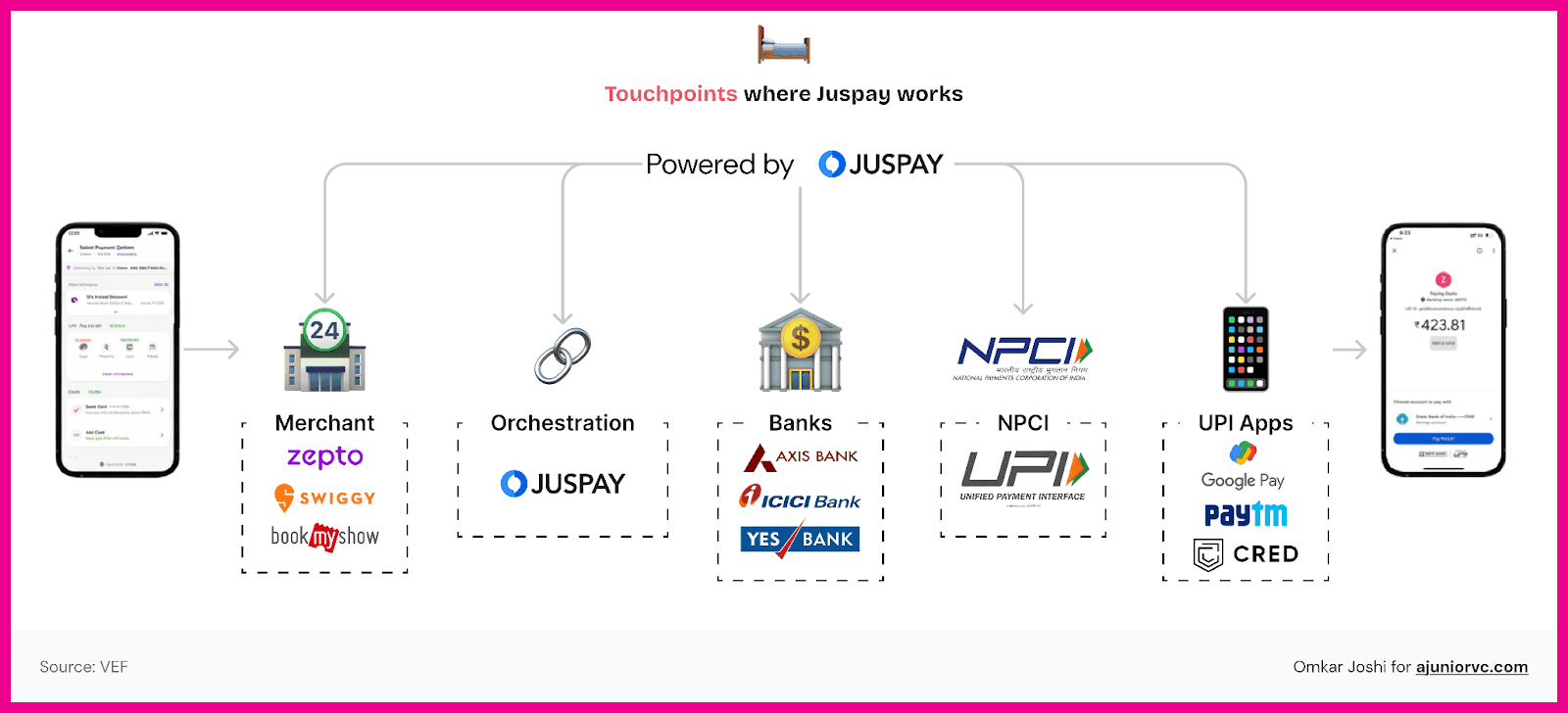

For companies operating at scale, reliability has become more difficult and more critical. This is where Juspay’s role expanded.

By building an orchestration layer that intelligently routed transactions across banks and handled failures in real time, Juspay helped platforms maintain stability as the system scaled faster than it was maturing. As banks struggled with overloads, Juspay’s cross-bank retries lifted UPI success rates for enterprise clients.

Latency was another killer. On platforms such as Ola, UPI response times increased from 1 second to over 20 seconds during the 2018 volume surges. Juspay’s optimisations brought this down to under three seconds, preserving nearly five per cent of GMV without requiring any changes to the app experience.

As PhonePe and Google Pay raced past 100 million users, periodic “UPI winter” blackouts became a regular feature of the ecosystem. Inside product teams, founders joked that UPI broke faster than it scaled. Juspay embedded itself as the unsung stabiliser across more than fifty apps.

Like demonetization cemented Juspay’s position for proof, UPI was now helping it scale.

Integration to Infrastructure

As volumes grew, Juspay expanded beyond checkout enablement.

Between 2018 and 2020, the Indian digital payments landscape was reshaped by the rapid adoption of UPI. UPI saw a 191% increase in total transaction volume, reaching 10B in 2019 from 3.8B in 2018.

Within this environment, reliability and orchestration became critical infrastructure primitives for enterprise platforms operating at scale. Middleware layers that improved routing, retries, tokenisation, and system-level monitoring helped merchants navigate the complexity of multiple PSPs and bank interfaces, even as standard rails were still maturing.

These capabilities have increasingly extended beyond simple checkout enablement to tokenisation tools, real-time monitoring, and systemic orchestration, reducing declines and improving end-to-end success rates.

Regulatory developments reinforced this positioning.

As RBI tokenisation and other compliance requirements took shape, payment infrastructure providers with built-in tooling were better positioned to absorb these changes efficiently. Those prepared with compliance-ready components could implement regulatory mandates more quickly than competitors, who would otherwise have to retrofit systems mid-cycle, turning readiness into an operational advantage in merchant integrations.

The depth of integration also affected the economics of switching. With orchestration bridging numerous PSP-bank combinations, deeply embedded layers carried real operational risk for merchants if removed, as fallback and revalidation work could extend into weeks during migration.

Specific examples of operational continuity in this era highlighted this value. During peak festive cycles in 2019 and early 2020, intelligent routing and failover mechanisms helped ensure checkout stability for large platforms even as underlying system load increased. Reliability became less a standalone metric and more a foundation for scale and resilience across enterprise stacks in India’s emerging payments ecosystem.

At this depth, replacing Juspay was both commercially unviable and operationally risky.

Regulation as a Feature

As RBI scrutiny intensified around payments, data localisation, and tokenisation, many fintech companies experienced regulation as friction.

Between 2020 and 2022, regulatory mandates reshaped the industry. RBI’s tokenisation requirements, effective from 2021, and strict data localisation rules compelled more than 90 per cent of card-dependent fintechs to undertake urgent compliance efforts. Non-compliant players faced outages and operational halts. For some, failure rates spiked to 20–30 per cent during enforced blackouts.

Juspay treated regulation differently.

It approached regulation as a design input rather than a constraint. By working closely with banks and regulators, Juspay built systems that were compliant by default. Instead of working around the rules, it is designed within them.

This preparation showed. Juspay’s Card Vault was already tokenisation-ready when the mandate took effect. Banks were onboarded seamlessly. While competitors struggled to stabilise, Juspay maintained an uptime of nearly 99.9 per cent and captured approximately 80 per cent of themarket share among its largest clients.

As regulations tightened, trust improved. Banks and large merchants preferred partners that reduced regulatory and operational risk rather than introducing new points of failure.

The broader crackdown reinforced this shift.

The RBI scrutinised more than 100 payment aggregators, returned 57 licence applications, and halted operations for several non-compliant firms, including Ola Financial and Ezetap. Juspay secured in-principle approval as a payment aggregator by the third quarter of 2022. By then, it was processing over 500 million tokenised transactions annually without penalties, at a time when the industry faced disruption rates of nearly 15 per cent.

Operationally, banks began rerouting volume. Nearly 70 per cent of high-volume transaction flows shifted toward partners deemed “risk-proof.” In 2022, a wave of audits tested the ecosystem again. Juspay’s pre-built localisation vaults cleared inspections on the first attempt, while peers spent millions on consultants and remediation. One industry executive put it bluntly: regulation became Juspay’s R&D budget; others paid penalties.

After the RBI imposed restrictions on Paytm Payments Bank, Paytm’s share of UPI transactions declined significantly, from around 13% in January 2024 to about 9 % in subsequent months. Unfortunately, Paytm communicated to merchants that, effective April 1, 2025, it would no longer route transactions through third-party platforms, including Juspay, and would instead process payments directly via its own PPSL infrastructure.

The focus on being infrastructure, rather than a wallet, was starting to play our.

Scaling Gateway

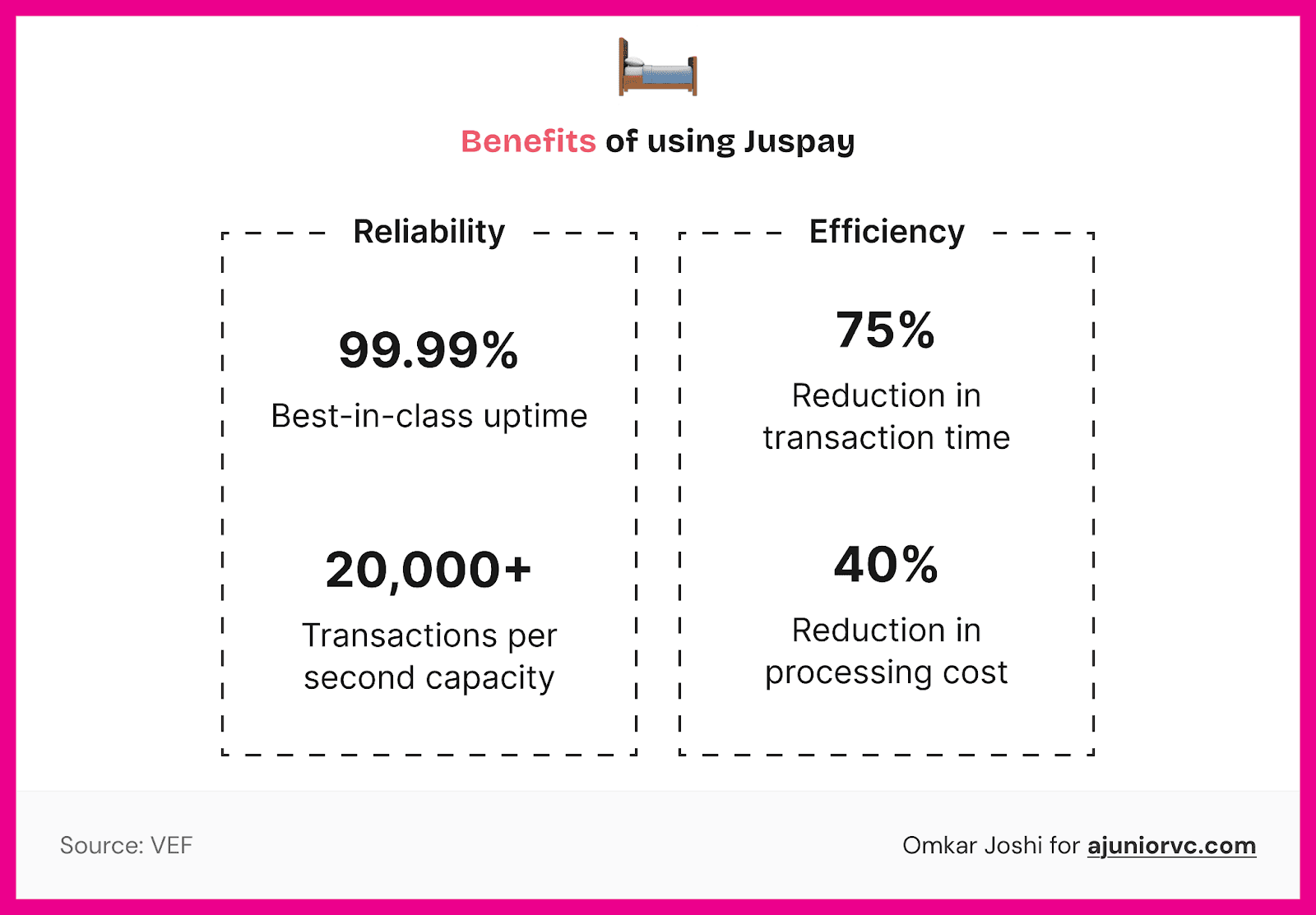

Regardless of the fluctuations, as of FY25, Juspay processes over 300 million transactions daily across UPI, cards, and emerging payment rails.

It processes approximately $1 trillion in annualised transaction value with 99.999 per cent uptime, embedding itself deeply within the infrastructure of Indian digital commerce. While much of the fintech sector pursued consumer visibility and super-app ambitions, Juspay remained deliberately low-profile, routing top e-commerce flows without consumer-facing branding.

Expansion beyond India followed the same infrastructure-first logic.

Partnerships with Agoda and Zurich Re increased non-India volumes, demonstrating that the stack scaled internationally without compromising the reliability shaped by India’s regulatory and volume intensity.

Despite this growth, Juspay resisted pressure to evolve into a consumer-facing fintech brand. As peers invested heavily in advertising and brand recall, Juspay declined a proposed 2025 super-app pivot, summarising its role internally as infrastructure rather than interface.

That positioning proved durable. Leadership visibility remained secondary; engineering continuity took precedence. Trust was built through uptime.

Juspay’s trajectory is shaped less by ambition and more by constraint. It is unlikely to become consumer-facing; neutrality remains central to its model. Instead, the company is moving deeper into regulated infrastructure, open banking, cross-border payments, and system-level monitoring, where trust and compliance matter more than visibility.

The roadmap reflects this choice.

Juspay secured $50 million in a Series D follow-on round from WestBridge Capital. The investment valued Juspay at $1.2 billion. By opening the stack, Juspay positioned itself as an anti-lock-in alternative as merchants reassessed their dependence on closed gateways.

Juspay’s advantage lies neither in speed nor in branding. It is trust.

Invisible Compounder

Juspay’s trajectory does not conform to the typical startup narrative.

It did not chase growth at all costs. It did not burn capital to buy users. It did not try to become visible. Instead, it solved for failure. It prioritised infrastructure over attention and, over time, compounded trust.

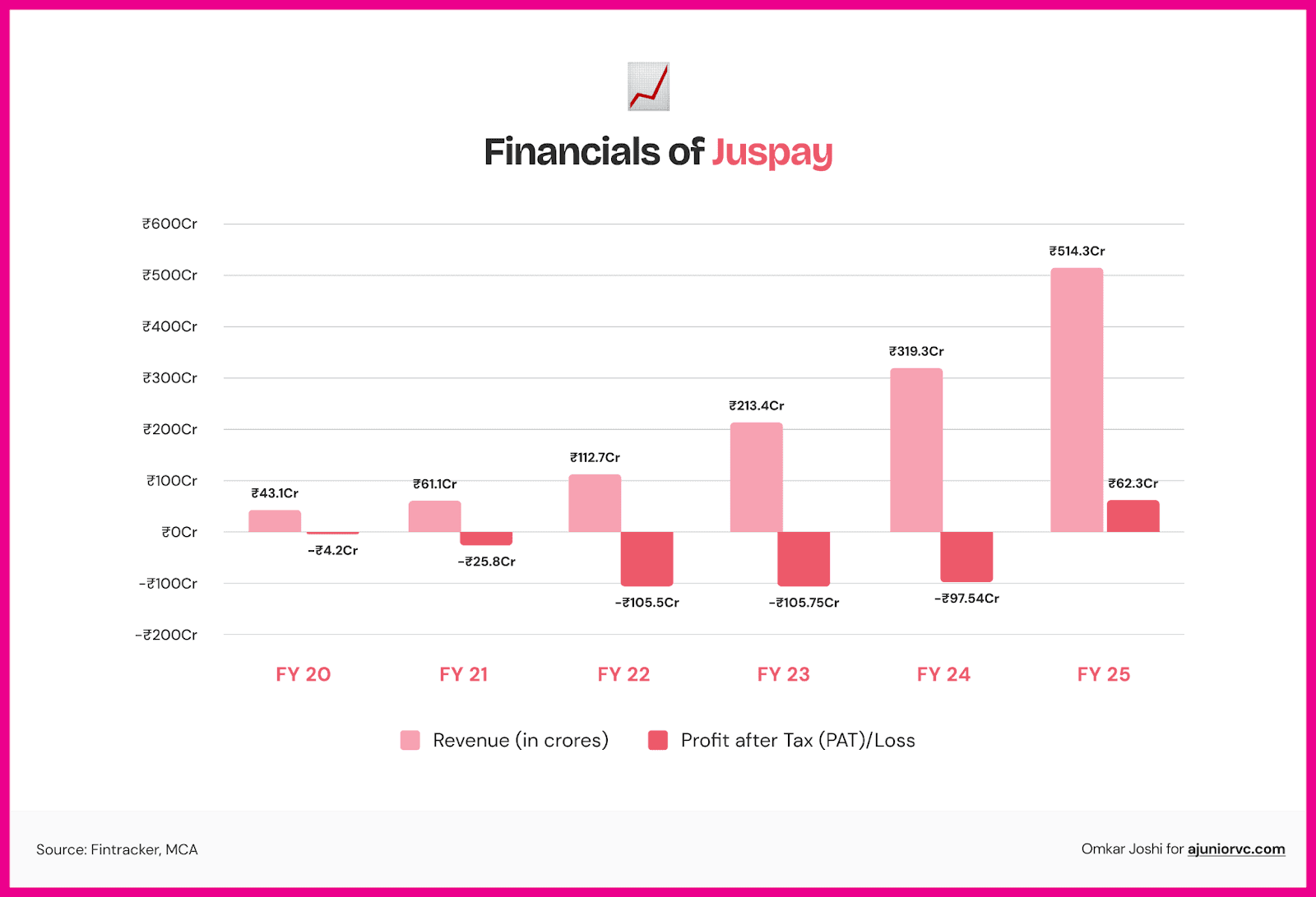

That contrarian path delivered outcomes others struggled to match. By FY25, Juspay was profitable, posting ₹62 crore in PAT on ₹514 crore in revenue, up 61%, while much of the ecosystem chased valuations amid churn.

The company has taken 14 years to remain focused, determined, and true to its cause to arrive here. The trajectory looks increasingly exciting. Regulatory alignment continued to be the wedge. I

In January 2026, Juspay secured an RBI cross-border payment aggregator licence and began working with global networks like Visa and Mastercard. Enterprise builds followed quickly. An HSBC acquiring stack spanning 10 markets was deployed within six months, demonstrating that the model could scale beyond India without sacrificing control or compliance. Expansion plans now point toward Southeast Asia, Europe, and the Americas.

The unicorn began by asking an uncomfortable question about payment failures a decade ago. It is now asking the uncomfortable question about payments as it seeks to position itself as a global orchestrator.