Jul 10, 2022

Can LEAD School Lead Indian EdTech with Its Long Game?

Profile

Education

SaaS

Platform

B2B

Series E-G

Last fortnight, LEAD reported explosive growth due to the unlocking of schools, hot on the heels of a unicorn fundraise earlier this year.

Burn like a Sun to Shine Like a School

Smita Deorah had begun her young career at PwC.

A top-ranking Chartered Accountant, she soon moved on to P&G in Singapore as a junior finance professional. As she was rising through the ranks, she met a colleague at P&G and got to know him better through their car rides.

The erstwhile bus-taking colleague was Sumeet Mehta. Sumeet was in an entirely different division, managing brands. Like Smita, he too was talented, having secured an MBA from a Well-Known Institute of Management in Western India.

The two would get to know each other and would end up becoming husband and wife. After spending more than a decade in large corporations, the two began to gravitate toward their itch.

Smita and Sumeet always wanted to do something in education. Having struggled to get a good school for their daughter, Smita was the first to take a plunge into entrepreneurship.

Smita founded Sparsh in 2011, having left Singapore to head home to India a few years ago.

Sparsh was a non-profit organization with a mission to impact the lives of young children from low-income communities. Sparsh ran K-12 schools in rural & taluka areas and provided access to high quality education.

While Smita started Sparsh, Sumeet had been the CEO of Zee Learn. Zee Learn operated in the K-12 segment with two iconic brands KidZee and Mount Litera Zee school.

These experiences in education for the couple helped them identify the problems in the education sector, particularly in the K-12 space.

Realizing that their experiences could help kids like their daughter, they decided to go full-time. Smita laid the foundation, and Sumeet joined to set up the branches.

The duo had created their new baby, LEAD school

LEADing children to Education

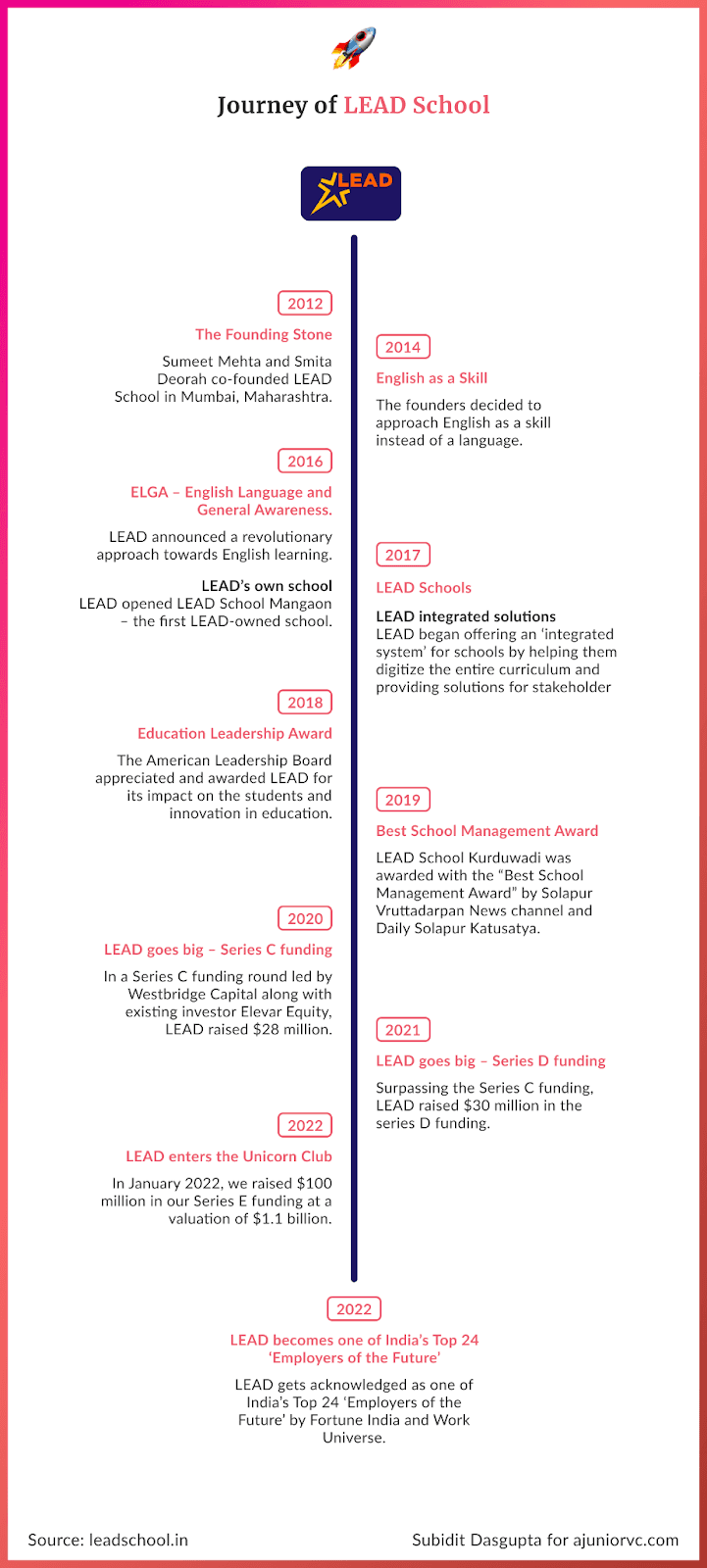

True to their vision of helping children at the bottom of the pyramid, LEAD School started in August 2012. Their first school was in Areri, a place 35 kms away from Ahmedabad with a grand total of 14 students on their first day.

Shortly afterwards, LEAD opened up 4 more centres in the Sholapur and Raigad districts of Maharashtra.

Long before EdTech was a thing, LEAD had already begun playing the long educational game.

They were staring at a huge problem that had been a graveyard for countless companies.

You Have To Dream Before Your Dreams Come True

It is well known that there are a lot of deficiencies in the Indian K-12 segment.

In general, the system focuses on rote learning and the students don't acquire the skills. The founders built on an insight they gained from their educational experience.

Parents choose to spend significant income to send their children to a good private school, thinking that 10-12 years later they will be set.

By the time they realise that their child is not ready for the job market, it is already too late. The broken education needed to be fixed first, not later.

Before the arrival of ed-tech, parents sent their kids to additional “tuitions” to cover for the lack of quality in the school. These additional expenses are a strain for the parents, particularly those from middle-to-low income backgrounds.

However, in India, parents do not wish to compromise on their kid’s education and spend additional resources to ensure that their kids have a better chance at succeeding in their life, even if these additional expenses prove to be financially difficult.

Around the time LEAD had started, the first generation of educational startups such as Byju’s focused on enabling this “tuition” market.

They prepared videos and materials much in advance and sold them to eager parents, who were more than happy to spend on giving their kids an extra “edge”.

Ideally speaking this was just a bandaid.

The best solution in this space was to empower the schools as the child was already spending 6-7 hours there daily, for five-six days a week.

What if there was an ed-tech product which covered the quality gap in the schools. What if it helped the teachers retrain for the new digital world, kept a tab on their progress, along with keeping a track of student performance over time. Once the solution had reached a certain scale, analytics could be employed to ensure performance improvement over time.

By 2014, LEAD had expanded to a few more schools.

The founders had initially started with the goal of building and managing schools. Their focus was private schools. Once they achieved the Proof-of-Concept with their first 5 schools in Gujarat and Maharashtra, they had confidence that their solution would work.

By 2015, they realized that English education was a big gap. They doubled down on the format, making English skilling a core of their curriculum across schools. In 2016, they opened their first entirely LEAD-managed schools.

However, setting up schools in all parts of the country, particularly focused on the low-income segment, Tier-2 and Tier-3 towns were becoming a massively capital-intensive exercise.

They needed to create a solution with all their learnings which could be adopted by existing schools all across the country.

LEAD built its technology solution in 2017 which offers an integrated transformational, school SaaS platform.

It would be a full-stack assessment, education and remediation platform. LEAD also provides a separate app for parents, which allows them to track their children’s progress and enables their students to learn from home

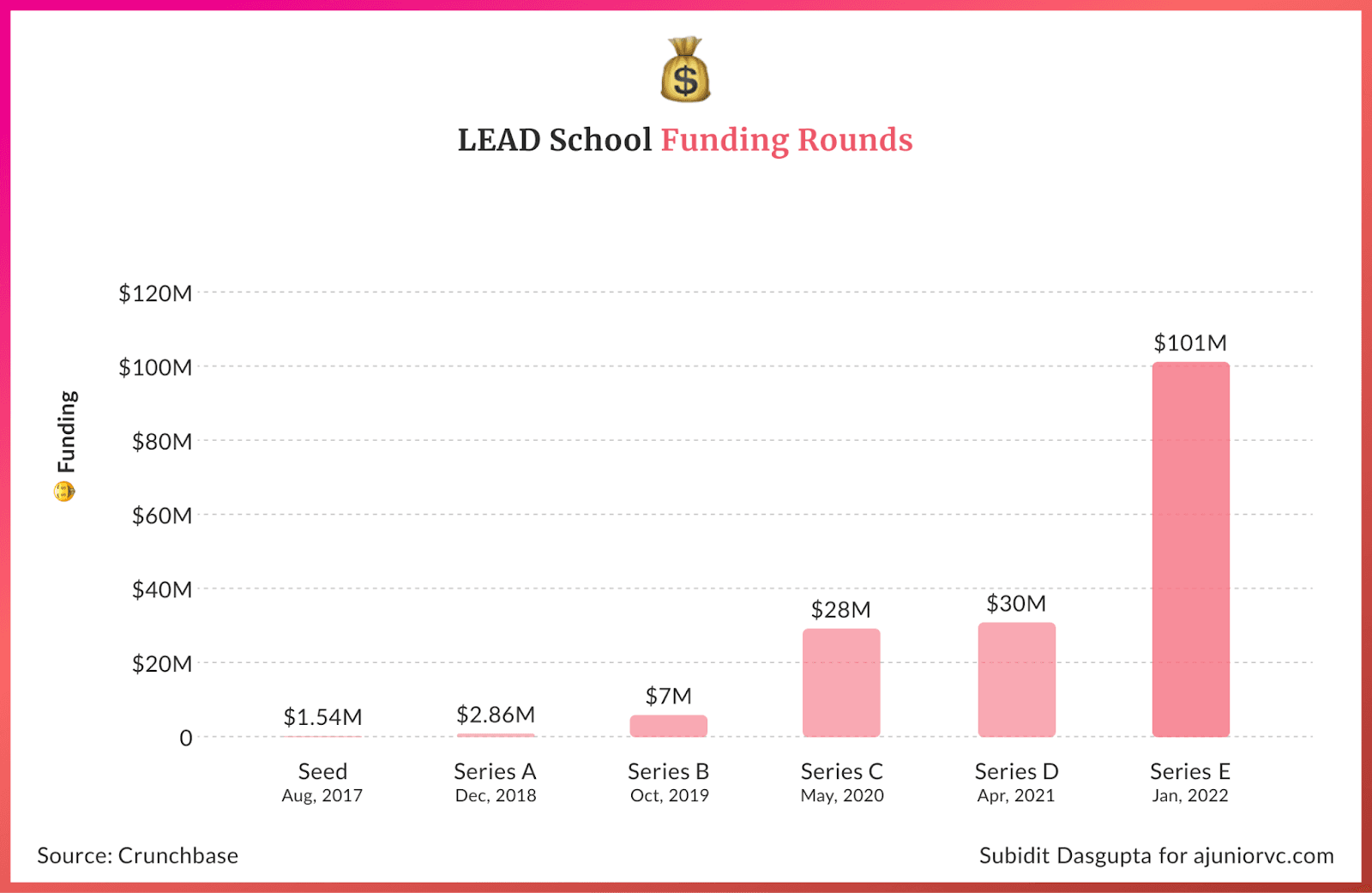

5 years after starting, it would end up raising its first round of funding in 2017. By this time, BYJUs had raised $150M and was already a unicorn.

LEAD seemed to be far behind its edtech counterparts. But the founders were playing the long game.

Rather than focusing on selling content through a deep sales network, LEAD was trying to meet education’s gold standard.

Great Teachers Emanate Out of Knowledge and Passion

The golden standard in education is to demonstrate improved outcomes in education.

While it is easy for a well-designed education solution to demonstrate outcomes, it is incredibly difficult for other solutions to move from claiming improvement to demonstrating it.

The first few years of actually running their own school were instrumental in developing the solution. Having skin in the game by running a school allowed them to be closer to the consumer.

This helped them to understand the consumer need and then the consumer problem. In these discussions, LEAD had figured out that having an English education was aspirational for many parents.

Parents feel that a quality English medium education will propel their children to shift orbit and escape their current reality. To help the current schools develop the skillset LEAD understood the problem in-depth and created the missing rungs for the child to take that leap.

Slow and steady customer feedback would drive their approach to building.

For example, in English education LEAD identified that the probable cause of the problem was the practice of teaching English as a subject instead of as a skill. This difference in viewpoint let to a lot of higher-order benefits.

It also enabled an English proficient student to learn other subjects in that language. The schooling management system, which they later developed, ensured that the required practices are embedded, in each of their customer schools.

LEAD had realized that taking the outcome-focused playbook to schools would be a game-changer.

The students in schools that LEAD entered were on average two to three grade levels behind, their teachers were woefully undertrained, and the schools themselves were financially insecure.

The trifecta of school, teacher and student drove this K-12 education. LEAD had to be the enabling act.

By 2018, LEAD provided the basic infrastructure to close the gaps, raising the performance of students, teachers and schools. This began to create a virtuous cycle which increased the enrollment of the school and improved its financial stability.

The upstart would win an educational leadership award. It would raise its next round, meagre compared to its well-funded edtech counterparts.

But under the radar, it was targeting a giant market.

The Big Market is Waiting

India in general possesses some macro-level trends that lend themselves to ed-tech growth

Most notable of these trends is a rapidly growing 1.4B population with 600M people under 25, and consumers that spend on education regardless of socioeconomic background. There was a total of $135B spent on all kinds of education, across the public and private sector.

However, when you think of “private school” what immediately comes to mind?

Swanky playing fields, well-furnished laboratories, air-conditioned classrooms filled with a small minority of well-fed rich children tapping away on their iPads.

In fact, that preconception is wrong.

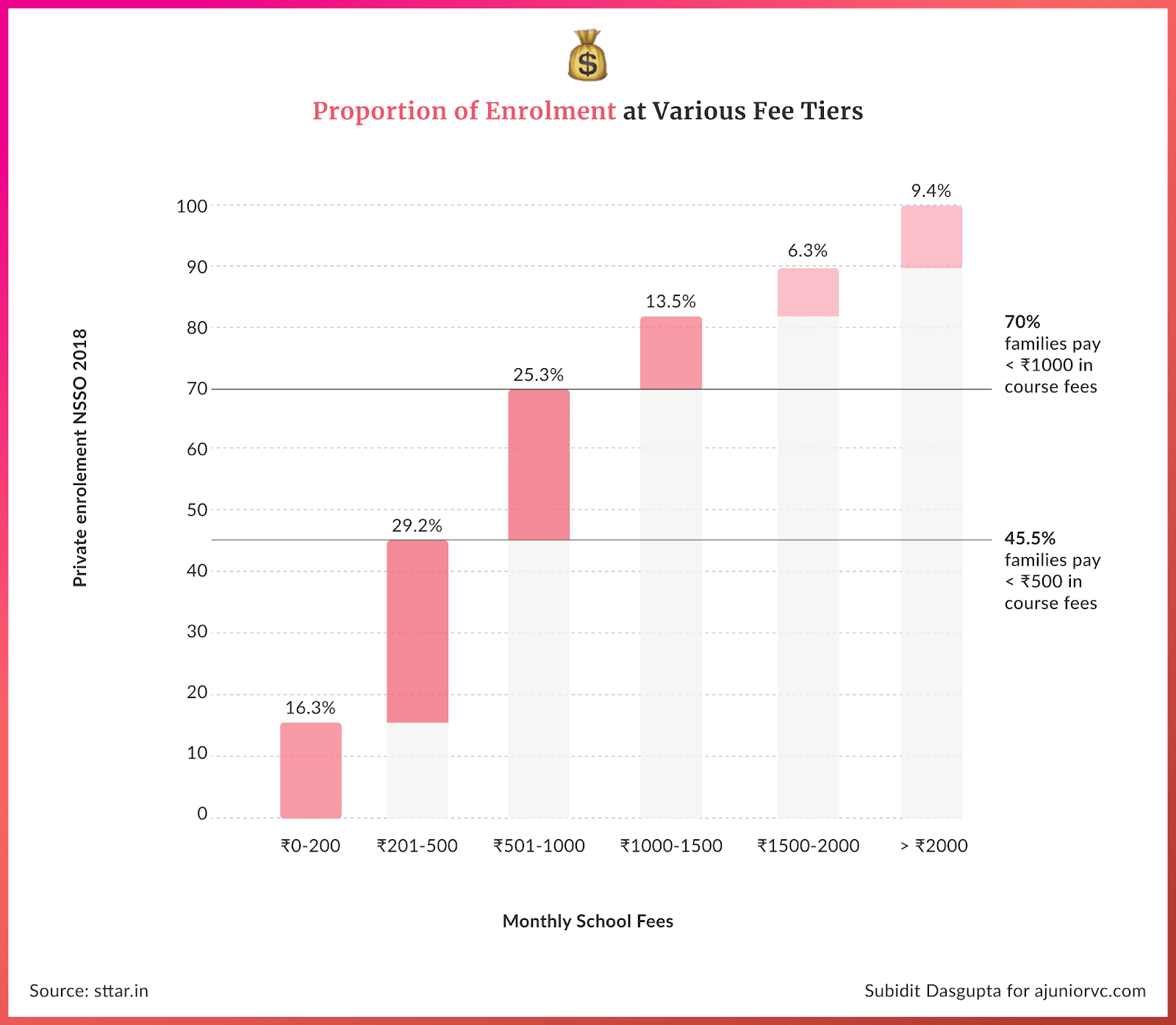

There are 450,000 private schools, serve 120 million students. Or nearly half of all students enrolled in schools in India.

In fact, after China and India’s government school system, it can be said that the Indian private school system by itself is enough to be the third-largest school system globally.

This growth was driven by a wave of middle and low-income families who aspire to provide better education for their children than the government facilities can provide. 70% of private school students paid less than Rs. 1000 (12 USD) a month in fees.

This was a very large market. Indian parents spend up to $20bn a year on school tuition fees and the school platform opportunity for LEAD is of the order of ~$10b.

A giant opportunity to create a massive Edtech company focused on digitizing the affordable private school market was up for grabs.

In their quest to serve affordable schools, how would LEAD make money?

Excellence is a Continuous Process, Not an Accident

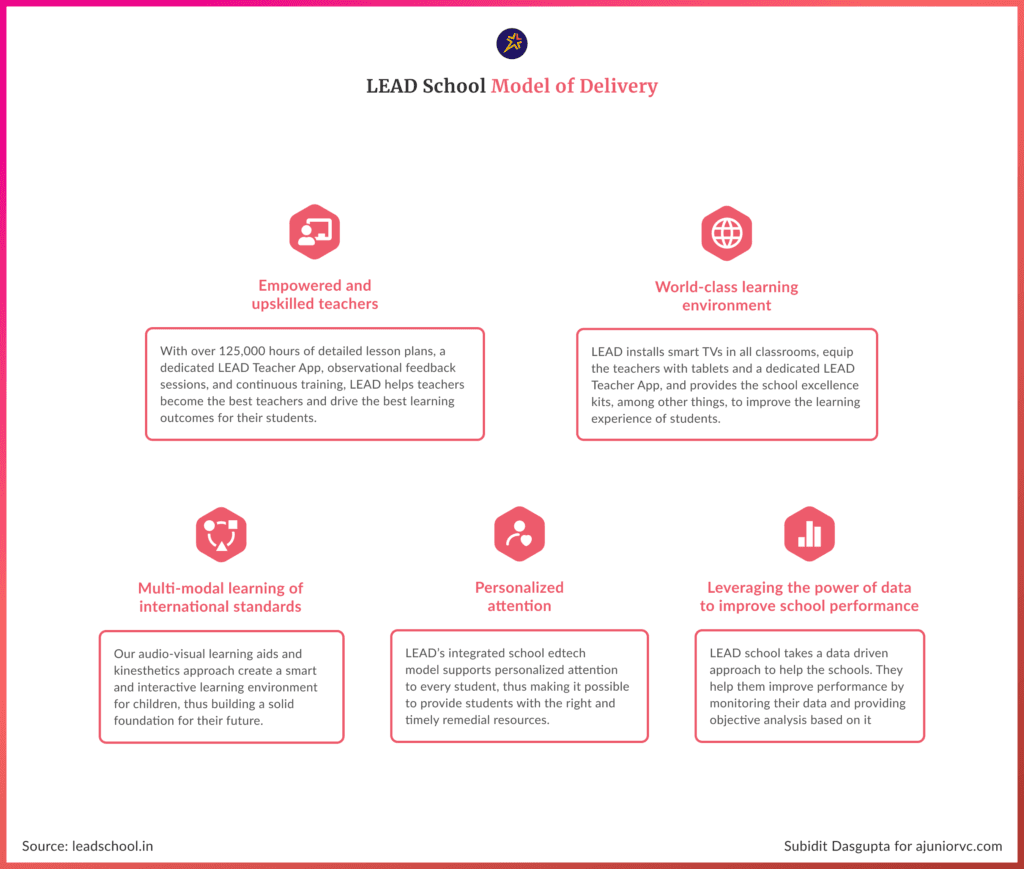

To understand how LEAD makes money, we need to understand how it works.

LEAD was not different from any SaaS business and charged schools a fixed fee of between Rs 1,400-2,300 per student, per year, depending on the offerings that were taken up.

This SaaS followed a two-pronged approach - one targeting the school’s own processes and the second focused on parents and children.

The first prong provided an operating system for running a school.

From tracking attendance, to student progress, to even replacing textbooks. Teachers got ‘Teacher Tablets’. These had content, lesson plans so that teachers don’t have to take on the administrative overhead of managing the class and planning lessons, and focus only on teaching and learning.

This made the solution pay for itself from the perspective of the school, since it frequently eliminates the need for a slew of other tools like an LMS, textbooks, and administrative software, in addition to helping increase school enrolment and school revenue.

By 2019, this value proposition may be one of the reasons it has a 100% net retention rate, which is defined in detail here

If the Net Revenue Retention rate is equal to or above 100%, it indicates that any revenue lost due to customers downgrading (paying less) or churning (leaving) is more than offset by the revenue gained from upsells, cross-sells, and add-ons for existing customers.

In this case, a 100% net retention rate means that the schools are increasingly engaging with and paying more for Lead School’s services.

The second prong of students and teachers involved enabling both.

Students receive at-home learning materials, and parents receive tools for tracking their children’s progress. These student tools are also multi-modal.

That means that in addition to smart classrooms with audio-visual lessons that the teacher facilitates, its iHomework app allows students to watch videos and read text content before doing workbooks or MCQ-type questions.

This is combined with a chat option that lets students clarify doubts with the teacher in real-time. These tools are part of the reason why the LEAD school was becoming increasingly effective.

In late 2019, LEAD conceptualized a “Managed School” programme.

Similar to e-commerce roll-ups like Thrasio, LEAD, for an increased fee, as opposed to acquisition, completely takes over the day-to-day task of the school. This includes everything from routine managerial tasks to even enrollment and admission.

While these models have largely struggled to scale up in India, it will be interesting to see if LEAD is able to do something different here.

As it entered 2020, the enabler of offline schools was going to face its toughest challenge yet.

Man needs Difficulties Because they are Necessary to Enjoy Success

LEAD’s transformation to asset light, a more nimble model helped lower the cost of running the school.

increased access, and also demonstrated better learning outcomes, claiming to improve class average marks from below 60% to 70%+.

By 2020, they were scaling at a tremendous rate, with 750+ schools adopting the system in just over one year.

It would then be hit with a sledgehammer.

When COVID hit in early 2020, 15 lakh schools went into lockdown, impacting the academic future of 26 crore children in India.

LEAD was hit hard but had to react quickly to remain relevant. This is when LEAD took a lead (no pun intended) to keep the lights on for learning for students.

As schools struggled to put together an online format of learning, LEAD become the first education provider to set up the largest online school.

It launched LEAD School@Home program, within a week from the start of the lockdown. It is crazy to think that a suddenly remote team was able to put all this together.

This first-of-its-kind initiative empowered lakhs of students to continue schooling without a single loss of learning day.

The high-quality learning program, which started with LEAD partner schools was eventually rolled out for every student in the country. A record 12 million class views were seen within 30 days of the launch of LEAD School@Home.

This initiative made remote or distance learning accessible to students in over 600+ English-medium schools, leading to a paradigm shift in India's school education system.

The team at LEAD also built solutions focused on teacher training as COVID-19 brought to the fore a severe crunch in teachers who were trained to provide online schooling.

LEAD set up LEAD Teachers’ Academy, to help educators address the challenges they were facing while imparting online education.

As the virus rapidly evolved the world over, LEAD continuously iterated to keep the learning engine moving.

In mid-2020, it would raise another round to enable it to grow. Schools are a notoriously difficult segment to sell to. The pandemic provided the enabler to LEAD to digitize countless schools.

Almost 7 years after founding, LEAD was finally beginning to take off, still continuing to play the long game.

Wings of Fire

True to its vision to make each stakeholder win, LEAD built solutions for all stakeholders.

In June 2020 it launched a Post-Lockdown School Handbook to help schools across the country plan and prepare for reopening their campus. The Handbook guided the schools in carrying out essential activities and focusing on health and hygiene with the responsibility of various stakeholders.

It also launched a Parent App, to keep parents updated on lesson plans, latest progress, and evaluation of their wards.

All of this product development meant the company was able to onboard 800 schools by 2021 onto its platform.

On the back of this traction, LEAD raised its Series D funding round of $28 million.

It is no surprise that LEAD has quietly taken a product-first approach and built several products almost in the shadows without any of the hype and bluster that is typical of ed-Tech companies in today’s times.

The fact that both founders had previous experience in the education sector meant .that the company always focused on outcomes and built products on sound education principles leveraging technology

Their business model is also fundamentally different when compared to several of the larger ed-tech incumbents like Byju’s, Vedantu, and Unacademy.

All of these incumbents operate a B2C-focused business model and have grown on the back of large marketing campaigns. This has also meant they have grown quite quickly while burning a lot of money on customer acquisition.

LEAD on the other hand operates a B2B business model and ties up with schools. Securing school partnerships is notoriously hard with multiple gatekeeper problems. Several companies have tried and failed.

But it is a testament to its operating and product chops that LEAD has managed to achieve its existing scale. This is more praiseworthy given their target segment of low-income private schools which is an extremely tough nut to crack along with legacy working capital issues.

Lead was winning the war but it would far from rest on its laurels.

Sacrifice Today so Children Can Have a Better Tomorrow

LEAD was quick to take cognizance of the post-COVID realities.

They took advantage of the world opening up post-COVID and peoples’ craving for offline experiences thus becoming the first and only Ed-Tech in India to launch a ‘hybrid school system’ for the 2021 academic year.

The hybrid school system enabled schools to deliver uninterrupted quality learning online or offline and at home or in school with world-class teaching pedagogies. This offered both schools and students greater flexibility as multiple waves made schools start, shut down and start again.

By end of 2021, the company had scaled to 2,000 schools catering to 800,000 students.

Like every company, LEAD had to deal with its own challenges.

Their flagship product LEAD Classroom is considered expensive for 80%+ of the market. The annual fees for the product currently range from Rs. 2000 to 3000. This means only schools with an annual fee of Rs. 20,000 or above can realistically afford to sign up.

This is particularly discomforting for a business that has stated that its mission is to be the go-to product for India’s 450,000 odd affordably private schools, 70% of which have an annual fee of less than INR 12,000.

There is also an urgent need for localizing the product.

India’s diversity is one of its most attractive features and that means cultural nuances, language and tradition vary every few kilometres. A one-size-fits-all approach has never worked in education and it never will. LEAD will have to address this sooner rather than later if it is to continue to scale as impressively as it has done thus far.

If it succeeds, schools may have the incentive to leverage the LEAD platform to build a brand and then leave. This incentive to churn after success could be a big problem.

Despite these challenges, LEAD has continued to scale, growing operations to 20 states across 400 cities and partnering with 3,500 schools. By end of 2021, it had also trained 25,000 teachers and served 1,400,000 students.

On the back of this continued scale, LEAD raised a Series E round of $100 million to become the first Edtech unicorn of 2022.

Unlike other edtech unicorns, it diluted less than 10% in this round. Even across its history, it diluted little in its rounds.

This spoke to the strength of the model, the nature of the founders and the long-term approach the business was taking.

While Lead had climbed a hill, it knew that it had a giant mountain ahead of it still to conquer!

Small Aim is a Crime, have Great Aim

LEAD’s ambition is to be the go-to solution to digitize Affordable Private School classrooms.

It will use this to make excellent learning accessible and affordable to more than 25 million students in India.

LEAD has rapidly grown, going from 600 schools two years ago to nearly 5,000 today.

Over the next couple of years, it wants to double that number, hitting at least 10,000 schools in the country.

It’s spending money in spades in order to do so. For the year ended March 2021, the company saw expenses of Rs 186 crore ($ 25 million)—a 1.8X rise over the previous year.

The company is undertaking several efforts to achieve this milestone, like setting up Experience Hubs inside partner schools.

These hubs highlight a student’s strengths and weaknesses, guaranteeing that a school will experience a bump in enrollments upon partnering with LEAD and also going as far as taking complete ownership of a school, a model which has historically struggled in India.

All these efforts reveal the scale of the ambition but also come with varying degrees of complexity.

So far the company has showcased solid chops in being able to build products and onboard schools onto their platforms but revenues are not commensurate for a company of such operating scale.

In FY21 the company reported a revenue of INR 57 Cr. growing 2x year over year boosted by COVID. Their school partnerships have grown almost 10x since then and revenue growth has kept pace growing to close to INR 600 Cr. on an annualized basis as of earlier this year.

It is also apparently entering the academic year 2023 with an ARR of $80M or 600Cr with plans to expand to other countries in Asia and Latam.

There is still a long way to go for them to achieve their revenue target of $1B from 60,000 schools in the next four years and propel learning for 25m+ students by 2026.

That said they clearly have a track record to suggest that you would bet against them at your own risk.

In India’s Edtech-fueled bubble, they have been a crazy outlier every student will be proud to have been a part of. Their slow and steady building is now reaping rewards, as the rest of the consumer edtech firms struggle to find their footing and justify valuations.

Having been a “follower”, LEAD school could lead Indian EdTech to play the long game.

Writing: Chandra, Keshav, Nilesh, Varun and Aviral Design: Saumya, Subidit, Omkar